Cloud Computing and Artificial Intelligence (AI) are transforming the banking sector by bringing new levels of creativity, efficiency, and security. Banks may improve client experiences, revolutionize processes, and obtain a competitive advantage in the market by utilizing these potent technologies.

The banking industry is at the forefront of digital transformation, driven by Artificial Intelligence (AI) and Cloud Technology. These advancements are reshaping how banks operate, interact with customers, and address challenges in a highly competitive and regulated environment. As the digital economy evolves, banks must adapt, innovate, and optimise operations to remain relevant. In today’s blog post, we will explore the significance of AI and Cloud Technologies in banking, outlining the challenges they address and the benefits they provide.

The Importance of AI and Cloud Technology in Banking

1. Revolutionizing Banking Operations

AI and cloud technology have become pivotal in modernising banking by:

Streamlining operational processes.

Enhancing customer experiences through data-driven insights.

Strengthening security frameworks.

2. Adapting to a Competitive Landscape

Banks face increasing competition from Fintechs and Neobanks, which leverage agile, cloud-native infrastructures and AI-driven services. Traditional banks must adopt similar technologies to remain competitive

Challenges in Traditional Banking

Traditional banking systems often struggle with limitations, such as:

1. Legacy Systems

Outdated systems hinder agility, scalability, and integration with new technologies.

2. Costly Infrastructure

Maintaining on-premises data centres is expensive, inefficient, and limits innovation.

3. Evolving Customer Expectations

Modern customers demand personalized, on-demand banking experiences that legacy infrastructures cannot support.

4. Cybersecurity Threats

Increasingly sophisticated cyber threats challenge banks to safeguard sensitive customer and financial data.

AI and Cloud Technology: The Solution

1. Enhance Decision-Making:

Artificial Intelligence (AI) empowers banks to process and analyze vast datasets in real time. This capability transforms raw data into actionable insights, enabling financial institutions to:

- Identify customer trends and preferences.

- Predict market fluctuations for informed investment strategies.

- Detect fraudulent transactions instantly, mitigating risks.

AI-driven analytics allows decision-makers to act proactively, enhancing the speed and accuracy of critical business strategies.

2. Boost Agility:

Cloud technology revolutionizes banking operations by enabling unmatched scalability and flexibility. Key benefits include:

- Scalability: Banks can scale up or down their computing resources based on demand, optimizing costs and performance during peak periods like year-end transactions or festive seasons.

- Faster Innovation Cycles: Cloud platforms offer pre-built tools and infrastructure, accelerating the development of new banking products and services like mobile apps or digital wallets.

- Operational Flexibility: Employees can access secure banking systems remotely, fostering collaboration and efficiency in a globalized financial landscape.

3. Improve Security:

Cloud providers implement cutting-edge cybersecurity measures to protect sensitive banking data. Features include:

- Advanced Threat Detection: AI-powered systems identify anomalies and neutralize cyber threats before they escalate.

- Encryption and Authentication: Robust protocols safeguard data in transit and at rest, ensuring confidentiality and integrity.

- Regulatory Compliance: Cloud providers align with global and regional financial regulations, offering certifications like ISO 27001, GDPR compliance, and PCI DSS standards to ensure trustworthiness.

Evolutions of the AI and Cloud in the Banking Industry

1. The Era of Automation

Early banking automation focused on ATMs, online banking, and core banking systems. These innovations laid the groundwork for AI and cloud adoption.

2. Rise of Fintech

Fintech companies disrupted the industry by leveraging advanced technologies to offer seamless and cost-effective solutions.

3. Cloud-Native Transformation

Cloud computing emerged as a game-changer, providing banks with the flexibility and scalability needed to innovate.

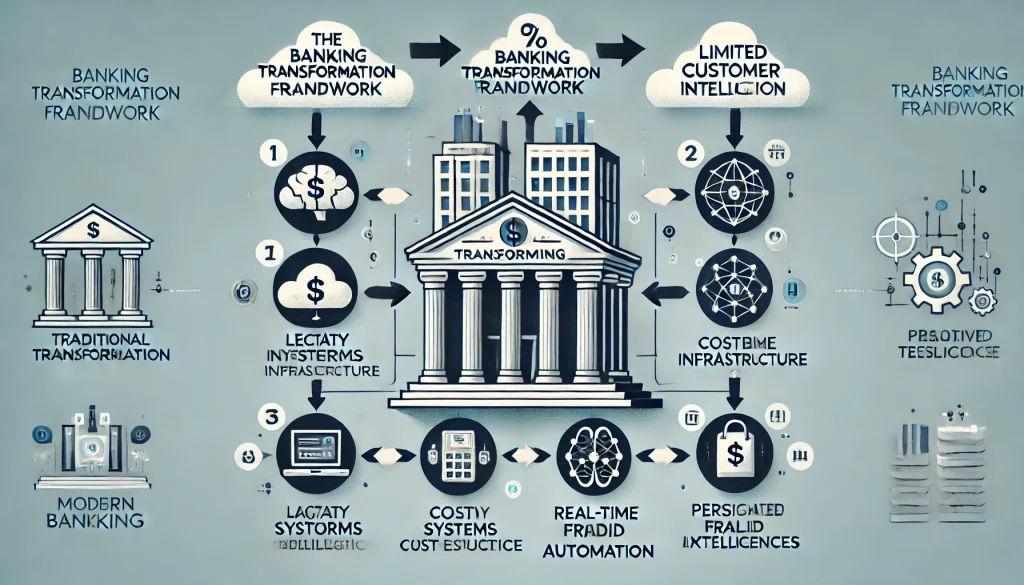

The Banking Transformation Framework

The Banking Transformation Framework illustrated in the image below represents a structured approach to modernizing traditional banking systems, leveraging advanced technologies to meet contemporary demands. The framework is broken into four key stages, showing a clear progression:

1. Traditional Banking (Top Section)

This represents the starting point of the transformation. Traditional banking relies on:

- Legacy Systems: Outdated software and infrastructure that hinder innovation and scalability.

- Costly Infrastructure: High maintenance costs for physical branches and servers.

- Limited Customer Insight: Inadequate tools to analyze customer needs and behaviors, leading to generic services.

The challenges here highlight the need for modernization to improve efficiency, customer satisfaction, and competitiveness.

2. Cloud Technology (Second Section)

The next step involves integrating cloud-based solutions. Key benefits include:

- Scalable Resources: Dynamic scalability to meet demand without significant upfront investment.

- Cost Efficiency: Reduced operational costs by using pay-as-you-go cloud services instead of maintaining expensive physical servers.

- Advanced Security: Enhanced protection with robust, regularly updated cloud security protocols.

Cloud technology provides the foundation for more agile and data-driven banking operations.

3. Artificial Intelligence (AI) (Third Section)

With the cloud in place, banks can harness AI to further revolutionize their services. AI enables:

- Data Analytics: Deep insights into customer behaviors, preferences, and market trends.

- Predictive Insights: Ability to anticipate customer needs and market changes to offer proactive solutions.

- Automation: Streamlining repetitive tasks like customer queries, fraud detection, and loan approvals, saving time and reducing errors.

AI turns data into actionable insights and automates processes, making banking smarter and more responsive.

4. Modern Banking (Bottom Section)

This is the culmination of the transformation, where banks deliver:

- Personalized Services: Tailored offerings based on individual customer preferences and behaviours.

- Real-Time Fraud Detection: AI-driven systems to monitor transactions and flag suspicious activities immediately.

- Seamless Experiences: A unified, intuitive experience across physical and digital channels, meeting customer expectations for convenience.

Artificial Intelligence in Banking

Artificial Intelligence (AI) has revolutionized the banking industry by enabling real-time decision-making, enhancing operational efficiency, and delivering unparalleled customer experiences. This transformation is not just a trend—it’s the new foundation for success. Banks leveraging AI are no longer just financial institutions; they are now tech-driven service providers redefining the customer journey and the business landscape.

How AI is Transforming Banking

1. Real-Time Fraud Detection and Prevention

Fraudulent activities are a persistent threat to the financial sector. AI empowers banks to combat fraud with unmatched precision:

-

Advanced Pattern Recognition: AI algorithms analyze millions of transactions per second, identifying anomalies that human analysts might miss.

-

Real-Time Alerts: AI systems flag suspicious activities instantly, minimizing damage and losses.

-

Adaptive Learning: AI models evolve continuously, learning from new fraud patterns to enhance detection rates.

Case in Point:

A leading global bank implemented AI-driven fraud detection, reducing false positives by 60% and saving millions in fraud-related losses annually.

2. Personalized Customer Experiences

In an era where customers expect tailored interactions, AI ensures banks deliver:

-

Hyper-Personalization: AI analyzes customer behavior, spending habits, and preferences to recommend personalized financial products.

-

AI-Powered Chatbots: Virtual assistants, such as AI-driven chatbots, provide 24/7 support, addressing queries efficiently and improving satisfaction.

-

Predictive Engagement: AI anticipates customer needs—offering mortgage advice, investment tips, or saving strategies—before customers even ask.

Impact:

Banks using AI for personalization report a 30% increase in customer retention and a significant rise in cross-sell opportunities.

3. Risk Management and Predictive Analytics

The volatile financial landscape demands robust risk management, and AI delivers by:

-

Assessing Creditworthiness: AI evaluates vast datasets—credit history, social behavior, and market conditions—to assess loan eligibility accurately.

-

Predicting Market Trends: AI models simulate economic scenarios, guiding investment decisions and reducing exposure to risks.

-

Mitigating Operational Risks: AI predicts potential system failures, compliance breaches, or market instabilities, enabling proactive mitigation.

4. Automation of Routine Banking Operations

AI reduces manual intervention, accelerating processes and minimizing errors:

-

Loan Approvals: AI-powered systems process loan applications in minutes, enhancing customer satisfaction.

-

Document Verification: AI automates KYC (Know Your Customer) and compliance checks, reducing processing time significantly.

-

Back-Office Automation: Tasks such as reconciliation, reporting, and data entry are streamlined through AI, freeing up human resources for strategic functions.

The Power of AI-Driven Insights

Banks generate vast amounts of data daily. AI transforms this raw data into actionable insights, offering competitive advantages:

1. Customer Segmentation

AI divides customers into precise segments, enabling banks to design targeted marketing campaigns and product offerings.

2. Sentiment Analysis

AI gauges customer sentiment through social media and feedback channels, helping banks address concerns proactively and improve their brand image.

3. Financial Forecasting

AI uses historical data and real-time market trends to forecast revenue, detect inefficiencies, and optimize strategies.

AI Tools Shaping Banking

1. AI Frameworks from AWS and Azure

Both AWS and Microsoft Azure provide robust AI frameworks tailored for banking:

AWS Machine Learning for Banking:

AWS offers tools such as Amazon SageMaker for developing, training, and deploying AI models. These models are instrumental in fraud detection and personalized recommendations.Azure AI Services:

Microsoft Azure’s Cognitive Services provide language understanding, speech recognition, and vision capabilities, enhancing customer interactions and operational efficiency.

2. AI-Powered Chatbots

Chatbots have become a hallmark of modern banking:

Azure Bot Service enables banks to create intelligent chatbots that integrate seamlessly across platforms.

Natural Language Processing (NLP): AI-driven chatbots understand customer queries with context, providing accurate responses and improving overall experience.

Example:

A major bank implemented an AI-powered chatbot using Azure, resulting in a 40% reduction in call center traffic and improved customer satisfaction ratings.